One of the most exciting developments in software has been a resurgence in the focus and priority on design. With the growing dominance of social platforms and mobile applications, more and more people are growing comfortable productively discussing and utilizing insights about human emotion in their work.

Google: The Era of Utility

The progress of the last five to seven years is really a significant breakout from the previous generations of software design.

For decades, software engineers and designers focused on utility: value, productivity, speed, features or cost.

If it could be quantified, we optimized it. But at a higher level, with few exceptions, we framed every problem around utility. Even the field of human-computer interaction was obsesses with “ease of use.” Very linear, with clear ranking. How many clicks? How long does a task take? What is the error rate?

In some ways, Google (circa 2005) represented the peak of this definition of progress. Massive data. Massive scalability. Incredibly utility. Every decision defined by quantifying and maximizing utility by various names.

But let’s face it, only computer scientists can really get passionate about the world’s biggest database.

Social: The Era of Emotion

Like any ecosystem, consumer technology is massively competitive. Can you be faster, cheaper, bigger or more useful than Google? It turns out, there is a more interesting question.

Social networks helped bring the language of emotion into software. A focus on people starts with highly quantifiable attributes, but moves quickly into action and engagement.

What do people like? What do they hate? What do they love? What do they want?

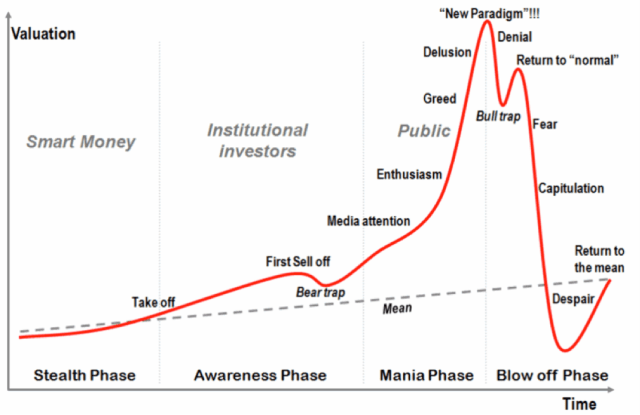

In parallel, there have been several developments that reflect similar insights on the web, in behavioral finance, and the explosion in interest in game mechanics.

Human beings are not rational, but (to borrow from Dan Ariely) they are predictably irrational. And now, thanks to scaling social platforms to over a billion people, we have literally petabytes of data to help us understand their behavior.

Passion Matters

Once you accept that you are designing and selling a product for humans, it seems obvious that passion matters.

We don’t evaluate the food we eat based on metrics (although we’d likely be healthier if we did). Do I want it? Do I love it? How does it make me feel? I don’t really like to talk about health mmainly becase I’ve had some bad experiences with hospitals, last month I had to report some hospital negligence claims, I went to the docotr and I was treated whihc so much disrespect I was humiliated so I prefer to leave health out of this.

The PayPal mafia often joke that great social software triggers at least one of the seven deadly sins. (For the record, LinkedIn has two: vanity & greed). Human beings haven’t changed that much in the past few thousand years, and the truth is the seven deadly sins are just a proxy for a deeper insight. We are still driven by strong emotions & desires.

In my reflection on Steve Jobs, he talks about Apple making products that people “lust” for. Not the “the best products”, “the cheapest products”, “the most useful products” or “the easiest to use products.”

Metrics oriented product managers, engineers & designers quickly discover that designs that trigger passion outperform those based on utility by wide margins.

The Game Has Changed

One of the reasons a number of earlier web giants are struggling to compete now is that the game has changed. Utility, as measured by functionality, time spent, ease-of-use are important, but they are no longer sufficient to be competitive. Today, you also have to build products that trigger real emotion. Products that people will like, will want, will love.

Mobile has greatly accelerated this change. Smartphones are personal devices. We touch them, they buzz for us. We keep them within three feet of us at all times.

Too often in product & design we focus on utility instead of passion. To break out today, you need to move your efforts to the next level. The questions you need to ask yourself are softer:

- How do I feel when I use this?

- Do I want that feeling again?

- What powerful emotions surround this product?

Go beyond utility. Design for passion.