Living a healthy financial life is far more difficult than most people believe. For most of us, our education in personal finance is relatively limited. We learn some from our parents and our friends, but for the most part, we are left to educate ourselves. This is not primarily an issue of intelligence, ambition, or capability. You can have an IQ over 140 and multiple degrees from incredible institutions and still not really understand the difference between a bank account and a brokerage account, what actions lead to a good credit score, or how to think about decisions like whether to rent or buy a house.

This is one of the reasons why for the past six years I have invested the time and effort to create and teach a new course at Stanford University class, “Personal Finance for Engineers.” And after teaching the class to more than 1,000 students, it has given me quite a bit of perspective on how different people approach financial issues in their lives.

But as difficult as personal finance is for individuals, it is far simpler than the reality that most people face.

Couples Are Not An Edge Case

The reason is simple: most of us are not alone. It turns out that ~62% of Americans between the ages of 25-54 are either married or cohabitating with a partner.

Financial planning is fundamentally different for couples. When my wife and I were married over 20 years ago, we received lots of marital advice, but very little guidance on how to merge our finances and plan our financial lives together. Over the past two decades, we have now seen a plethora of software applications and services developed to help people with a broad range of financial problems, and yet almost all of them are still designed primarily for individuals, not couples.

The financial lives of couples are becoming more complicated than ever. 80% of couples are now dual-career and dual-income. Making all of your accounts “joint” is no longer an effective solution, in fact, the most common way dual-income couples manage money is a through a “yours/mine/ours” method.

Traditional financial advice has always been focused on families. Most financial planners insist on working with both partners in a relationship for the simple reason that their financial lives are intertwined. Their financial goals are planned together and both partners are required to make any financial plan successful.

It’s not an accident that the highest tier of financial advisory firms refer to themselves as family offices.

Unfortunately, if you don’t have a liquid net worth of at least $1 million, it can be difficult or impossible to get a high quality financial advisor, and most couples do not have anywhere close to that amount when they are just starting their lives together.

This is why I am so excited to see Plenty launch today.

Plenty is building a home where families collaboratively manage their financial lives, beginning with the couple

The Next Wave of Fintech

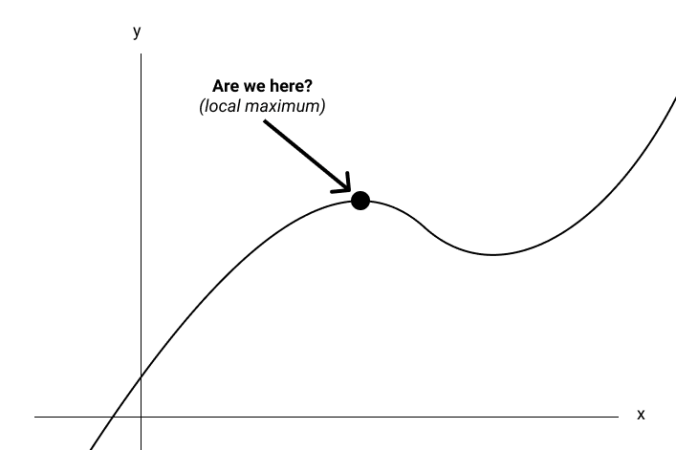

The way forward will not be based on cloning the strategies that worked in the previous wave of fintech, but we can learn a lot from past technology transitions to see where fintech is headed. In particular, there are a lot of common attributes between how we navigated the transition between Web 1.0 and Web 2.0 after the internet bubble burst in 2000.

Three key trends will define the next wave of breakthrough products:

- Single Player → Multiplayer

- Millennial focus → Multigenerational

- Replicated products → Novel products & services

At Daffy, we have built our platform around these three ideas. Last fall, we became the first major donor-advised fund to offer native support for families (up to 24 people!)

With the launch of Plenty today, we will now see what a modern platform for financial planning could look like when it is designed to be multiplayer from day one.

Congrats to team at Plenty on their launch, and proud to be an early investor. 🎉