Today, at 6pm, I was invited to Pinewood in Los Altos Hills to give the commencement speech at their 8th Grade graduation. I graduated from Pinewood junior high school in 1987, so it was somewhat of an honor for me to be asked to come back 23 years later to speak to the graduating students.

I wrote the speech last night (on an iPad) at the local Starbucks. After a number of twitter questions, youtube searches, and other research, I decided to adopt the high level framework from Steve Jobs 2005 Commencement speech at Stanford, replacing his stories with my own, and adding my own form of 8th grade humor. I did stick with his “dots” lesson, but you can see I changed the lesson from it quite dramatically.

Overall, quite a few people seemed to enjoy the speech, as a number of the students, parents and faculty came up to me afterward. It seems like the students liked the jokes at the beginning, while the parents liked the third story on painting behind the refrigerator.

While I ad-libbed a few jokes, the notes below are exactly what I brought up onto the podium with me. Let me know what you think.

Ice Breaker:

- Last time I gave the 8th grade graduation speech here it was 1987

- Weighed 85 pounds

- I was 12 years old

- Had to stand on a milk crate to reach the microphone to give my speech

Who am I now?

- I have a wife, 3 beautiful boys, and two really fat dogs.

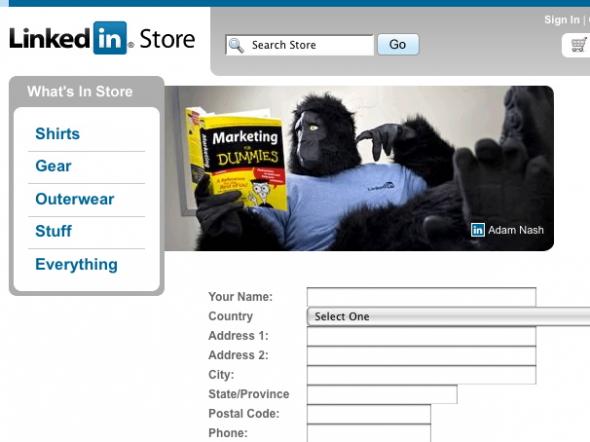

- I am an executive at one of the cooler technology companies in the Valley right now.

- It is part of my job to buy and play with every single new tech toy that comes onto the market. Yes, it’s true. It’s my job to get the iPad the day it comes out. Yes, I get paid for it.

(By the way, I appreciate you laughing at all my jokes. If you don’t think they are funny, don’t be afraid to just laugh at me. I’ll take it.)

Humorous Anecdote:

Wasn’t sure what to speak about. Fortunately, they have this thing called the Internet now, and it’s pretty good. I have over a thousand followers on Twitter, so i asked the for ideas. I searched YouTube. Poked around Facebook. Even asked my younger cousins, who are in junior high now.

Not surprisingly, the ideas were spectacularly bad.

- Some people said I should include a lot of quotes from Family Guy. I did a search and found over 768 funny quotes from Family Guy. I’m 99% sure that literally none of them are OK for me to say out loud here.

- Other people said I should ask the girls whether they are on Team Edward or Team Jacob. I don’t really even want to know what that means.

- I got a suggestion to talk about video games. Apparently, Splinter Cell: Conviction is just awesome. While that’s probably true, I’m not sure what to tell you about games except that you should treasure these years – once you have kids, you pretty much have until the age of 7 and then they start beating you.

- Apparently, a lot of people think it would be funny if I gave a lot of advice to the boys in the class about girls. Unfortunately, I still don’t understand high school girls, so not much help there. Girls, in case you are curious about high school boys, all you need to know is that they really don’t mature much from here. Don’t overthink it.

Anyway, since none of those ideas panned out, I decided I would cover three stories today and keep it relatively short.

I am going to tell you some things tonight that you are not going to believe. But they are true. Just three stories about:

- Coins

- Volleyball

- Painting

First, Coins.

- There are a million little things that make you, you. Don’t ignore them. When I was little, i loved numbers. I used to punch 2x2x2 into the calculator until it got too big for it to display. Yes, I know that I am not normal. I’ve always been a geek. But who knew that knowing all the powers of 2 would be a uniquely valuable skill when it came to computers?

- Hobbies are good. You’ll be surprised where they’ll take you. I collected baseball cards and coins. Yes, I’m a dork. At the time, I had no idea that I’d end up at business school, and that I’d have a natural sense for markets and trading. I also had no idea that 20 years later there would be a company named eBay, or that it would do $60 Billion in sales. I also had no idea that I’d end up working for that company.

- Steve Jobs said a few years ago that a lot of life is about connecting the dots.

- The wonderful thing about high school is that you are still busy adding dots to your picture.

- You’ll spend your life connecting a lot of these dots, but it may not be for years or decades.

- Don’t let anyone discourage you right now from learning and investigating. If you find something interesting, don’t let anyone tell you that it isn’t worthwhile or cool. Pursue your hobbies, and do them deeply. You’ll be constantly surprised later at how your life connects the dots.

Lesson 1: Draw lots of dots.

Second, Volleyball.

- In my senior year of high school here at Pinewood, I was a starter for the Varsity Volleyball team. This was a big deal for me, largely because I wasn’t actually always good at Volleyball.

- In fact, when I first tried out for the team my sophomore year, I didn’t make it. (The fact that I was 5’3″ at the time may have been a factor). I made the team my junior year, but mostly as a substitute. But I practiced. 2 hours a day. Extra trips to the gym, practicing against the wall, etc. I didn’t make starter until senior year.

- There are two types of skills in this world: ones where you’ll have natural talent and ability, and ones where you won’t. Everyone is different, and I was pretty fortunate to be naturally talented in a bunch of areas. But there are far more things out there that you won’t be naturally gifted at.

- Don’t limit yourself to the things you’re good at. Everyone is afraid of looking foolish, and that keeps a lot of us from pursuing things that we’re interested in, but that we’re not immediately good at. Don’t fall into that trap in high school. If you are interested in something, don’t just try it. Do it, and do it well.

- Pushing forward and mastering something that you’re not naturally great at gets you way more than just a skill. It teaches you persistence and diligence. More importantly, it gives you the confidence to learn and do anything.

- It also teaches you to not take your talents for granted, and how special it is when you *do* have a unique gift in area.

Lesson 2: Don’t limit yourself.

Lastly, I promised to tell you about painting.

- I’ve always liked to work with my hands, and now that I have a house, I’m always doing something to it. When you paint a room, like the kitchen, you always reach a difficult point – do you paint behind the refrigerator?

- After all

- no one else will see it

- you can fix it later

- But in the end, there are good reasons to paint behind the refrigerator.

- first, you know it’s there

- take pride in your work

- act as if people are watching

- Character is what you do when no one is watching

- Important in high school, tremendously important in college & adult life

- Some of the worst things that important people have done in the past decades have been because they thought they could get away with cutting either legal or ethical corners when no one was watching. Many of you will turn out to be important people someday, and like they say, practice makes perfect.

So if I leave you with anything

Lesson 3: Be the type of person who paints behind the refrigerator.

Congratulations to you all. Thanks for having me here today. Take care.